Posts

Showing posts from January, 2012

Sustainability Nears a Tipping Point

- Get link

- Other Apps

Tackling Lead Pollution with Fungi

- Get link

- Other Apps

Green Chemistry and Clean Energy

- Get link

- Other Apps

Renewable Energy’s IPO Misses Target—Is This Bad News for Biodiesel?

- Get link

- Other Apps

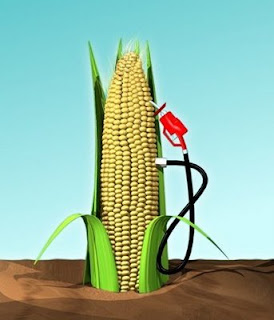

Higher Gas Prices: Ethanol Subsidy Expiration Could be to Blame

- Get link

- Other Apps

‘Prepare for Low-Carbon Economy This Year,’ Ex-UN Climate Chief Says

- Get link

- Other Apps